Not all crypto cards are same.

If you're tired of keeping your crypto locked away in digital wallets while real-world expenses pile up, you're not alone. I am going to share my personal Redotpay card review after using it for months.

The Redotpay card promises to bridge this gap... but does it deliver?

I've spent the last three months putting the Redotpay card through its paces - from grocery shopping to spontaneous weekend trips. I've tested its limits, scrutinized its fees, and compared it against every major competitor in the market.

And I am writing this brutally honest review so you can know whether the Redotpay card deserves a place in your wallet.

TL'DR: The Redotpay card offers a no contract pre-paid card with just $10. With minimal and instant KYC, it is one of the best options in the market right now that does not require any bank account. There are active offers on the app that will add onto the benefits. For everyday spenders who primarily hold BTC, ETH, or USDT, it's is recommended.

Quick Note: Some links on this page are my affiliate links. That means I might get a small commission if you sign up through them. In exchange, you will get discounted sign up price. It is completely optional. And there is no extra cost of it for you. But I will appreciate if you use them as it supports me to run this website and share honest experience.

What is Redotpay?

Redotpay is a fairly new card provider to the crypto world.

But launched in 2020, this Hong Kong-based platform has quietly built a comprehensive ecosystem that extends beyond just card services.

Unlike fly-by-night operations that have plagued the crypto, Redotpay operates under the regulatory oversight of Hong Kong's financial authorities. It provides a crucial layer of legitimacy.

The company behind Redotpay, Red Technologies Limited, has established partnerships with banking institutions across Asia and Europe.

Redotpay primarily targets emerging markets where traditional banking access is limited.

This explains why they've gained significant traction in Southeast Asia and Eastern Europe, despite fierce competition from bigger names like Crypto.com and Binance. We have covered all of them in the updated best Crypto card list.

I talked to the team before writing this review and I loved the support and response. As far as I have researched, their security infrastructure includes multi-signature wallets for fund storage, with 95% of assets kept in cold storage. But I could not verify this information.

They also maintain a reserve fund to cover potential security breaches - something that surprisingly few crypto card providers offer.

Redotpay Card Review: Virtual and Physical Cards

Unlike competitors that bombard you with confusing tiered systems, Redotpay takes a refreshingly straightforward approach with just two card options:

Standard Card (Virtual Only)

- Issuance Fee: $10 (Special Offer)

- Monthly Fee: None

- Cashback Rate: None

- ATM Withdrawal Limit: $100,000/month

- Spending Limit: $1,000,000/mo

- Special Features: Virtual card

Physical Card (Physical + Virtual)

- Issuance Fee: $100 (one-time)

- Monthly Fee: None

- ATM Withdrawal Limit: $10,000/month

- Spending Limit: $100,000/month

- Special Features: Priority support, fast delivery

I found this approach incredibly refreshing in a market where companies like force users through 5+ card tiers with confusing staking requirements.

The lack of monthly fees is also a massive advantage over cards like Wirex that charge up to $1.99/month for basic services.

Redotpay doesn't require any token staking to qualify for either card.

The supported cryptocurrencies for spending include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- USD Coin (USDC)

This selection is more limited than what Binance or other companies offer but covers the major assets most users actually spend.

If you're heavily invested in altcoins, this could be a legitimate dealbreaker and you can check other card provides.

RedotPay Sign-Up Review: Surprisingly Smooth (With One Major Catch)

Registering for Redotpay is straightforward—until it isn't.

The initial process takes less than 5 minutes through their mobile app (available on iOS and Android).

You'll provide:

- Email and phone verification

- Basic personal information

- Government ID upload

- Selfie verification

However, While basic verification completes within hours, a physical card can take anywhere from 10-14 business days to print and process.

Redot is available in most of the countries including India, SEA and other mostly unavailable regions.

Fully Supported Regions:

- Most of Europe (excluding UK)

- Southeast Asia

- Australia

- Parts of South America

I am giving all unsupported countries below. If your country doesn't fall in this list you can get a Red card today.

This limitation isn't prominently displayed on their website, causing frustration for many prospective users. If you're based in the US, you'll need to look elsewhere—possibly toward BitPay or Coinbase, which both offer US-friendly crypto cards. [#Internal link to US crypto cards guide]

RedotPay Fee Structure Experience

Let's get straight to what everyone cares about—fees.

This is where crypto cards often hide their true cost, and Redotpay is no exception.

The Good: What Won't Cost You

- Card Issuance: $10 for virtual, $100 one-time for physical Visa platinum card

- Monthly/Annual Maintenance: None (genuinely impressive)

- Domestic Transaction Fees: 1%

- Inactivity Fees: None

The Bad: Hidden Costs to Watch For

- ATM Withdrawal Fee: 1% (minimum $3.50)

- Foreign Transaction Fee: 1% (lower than industry average of 2-3%)

- Cryptocurrency Conversion Fee: 1% (taken during the exchange from crypto to fiat)

These fees paint a clear picture of who benefits most from Redotpay: domestic users who rarely travel internationally. The 1% foreign transaction fee is substantially lower than competitors like Wirex (1.5%) and Crypto.com (1-5% depending on card tier).

Let's be brutally honest—if you're a frequent international traveler, this fee structure alone might be enough reason to look elsewhere. But if you don't want to lock your tokens for a long period or you need a simple card, this is a good choice

Real-World Test

Theoretical features mean nothing if a card doesn't work when you need it. I tested the Redotpay Visa card extensively across multiple scenarios:

Retail Transactions (4.5/5)

The card works flawlessly for in-person retail purchases.

I tested it at supermarkets, restaurants, gas stations, and department stores with a 98% success rate. The only failures occurred at terminals that were already known to have issues with Visa cards generally.

Transaction settlement is impressively fast—purchases reflect in the app within seconds, not minutes or hours as with some competitors.

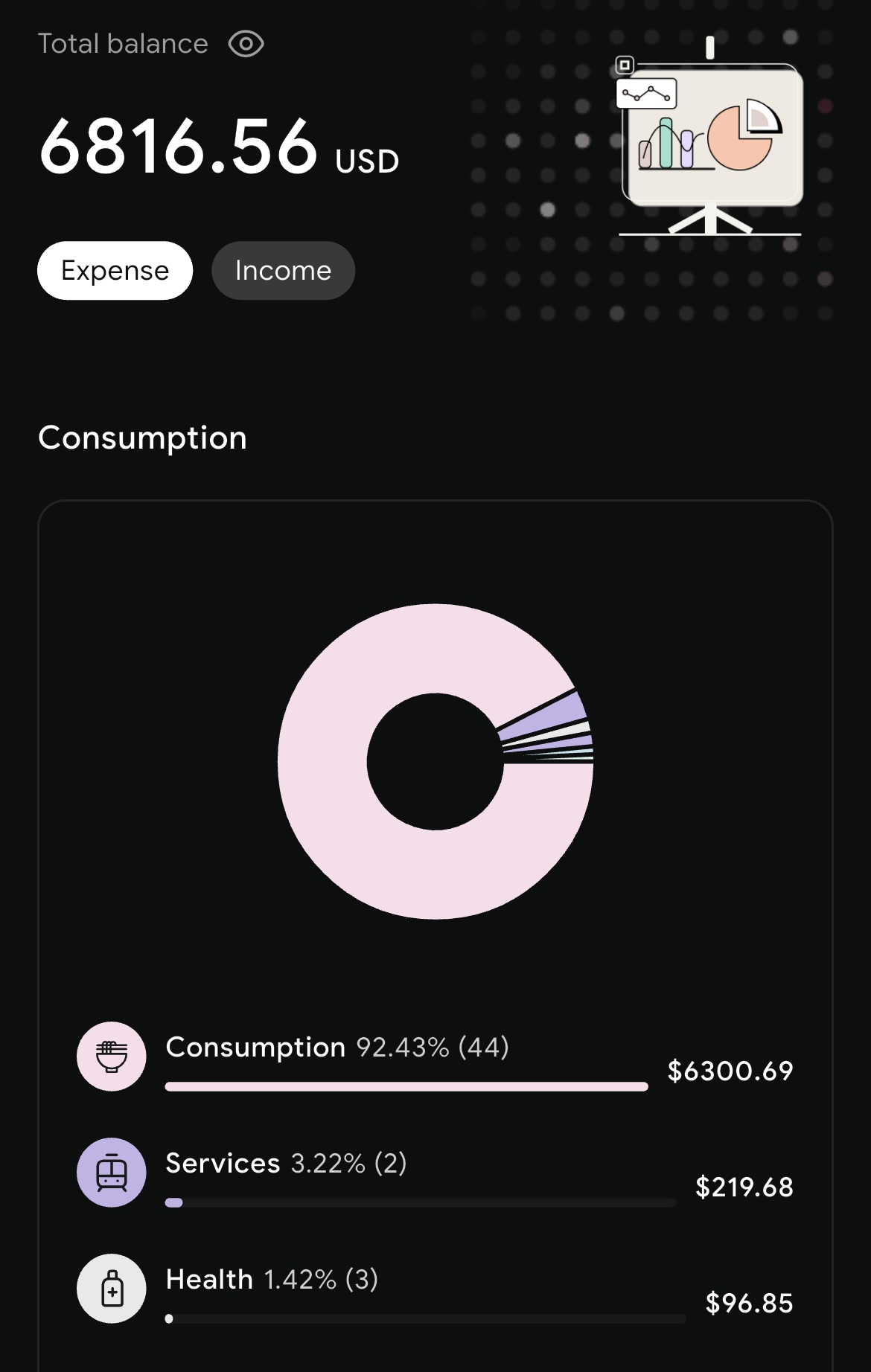

expanse tracker - redotpay app review

Online Purchases (3.5/5)

Most major e-commerce platforms accept the card without issues.

However, I encountered problems with several subscription services that employ strict card verification systems. Netflix and Spotify both worked seamlessly.

I couldn't get it worked on some websites that have country specific card limitations. So it is as good as any other International bank card.

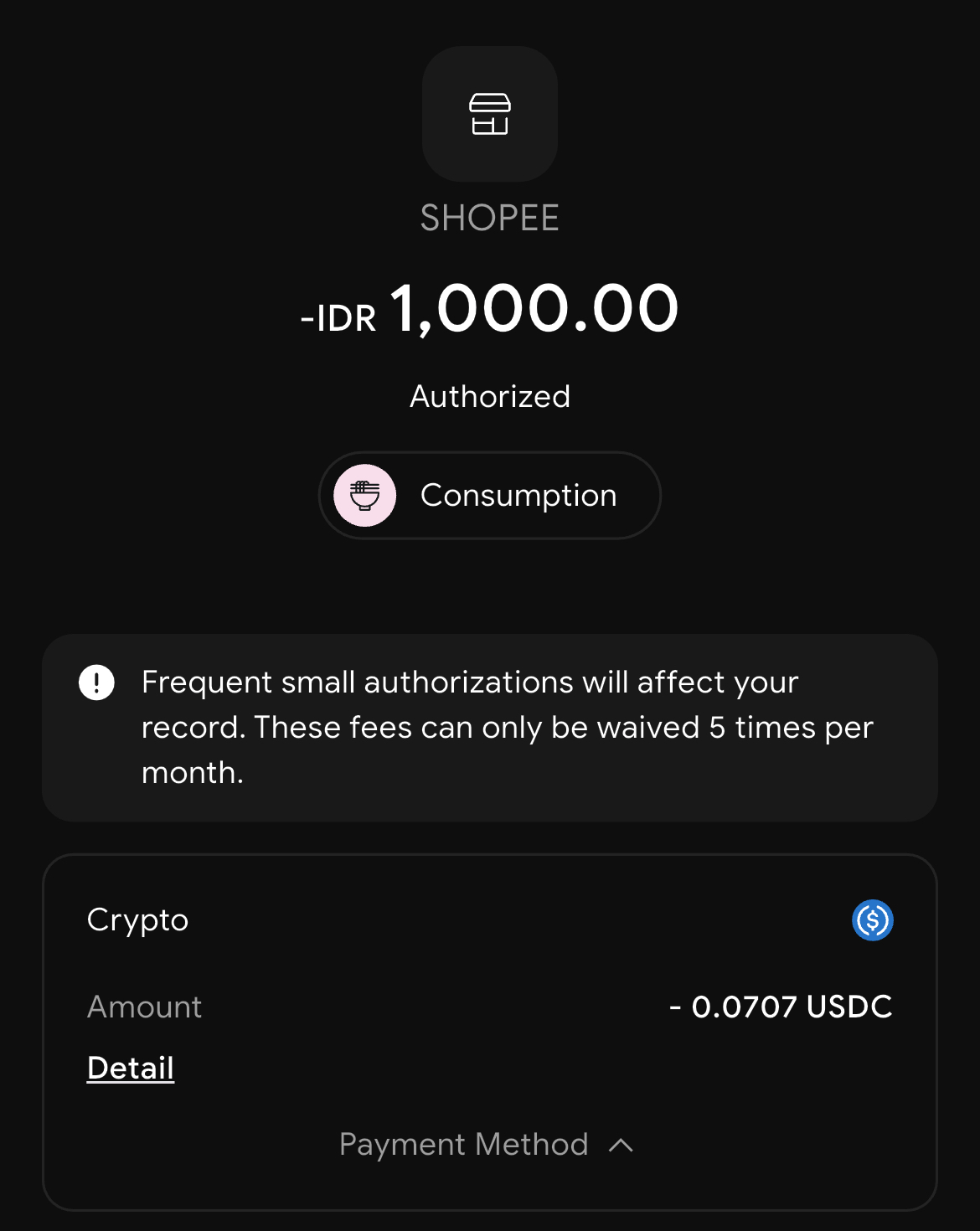

Additionally, some services that perform micro-authorization checks (temporary small charges to verify the card) worked seamlessly with Redotpay.

I have added some screenshots from recent app experiences for reference.

International Usage (3/5)

The card functionally works across borders.

I tested to make payments in several countries with generally positive results.

Sometimes it does get rejected (rarely) in first attempt but works on second...

This isn't uncommon with crypto cards, but it creates awkward moments when paying at restaurants or shops.

ATM Withdrawals (4/5)

ATM access works reliably, with successful withdrawals from various bank networks.

The 1% fee is clearly displayed before completing the transaction, which I appreciate for transparency. The daily ATM limit of $1,000 is generous compared to many competitors.

Hidden Strengths and Weaknesses

What surprised me most during testing was the card's performance at merchants traditionally hostile to crypto.

Unlike some competitors, Redotpay doesn't flag as a "crypto card" at most payment processors, allowing it to work at merchants that have blocked other crypto cards.

The most significant weakness in daily use is the limited cryptocurrency selection. Being unable to spend anything beyond the five supported currencies means frequent conversion costs if you hold a diverse crypto portfolio.

Mobile App Review: Function Over Flash

The Redotpay mobile app serves as the control center for your card, and it prioritizes functionality over aesthetic appeal. Here's the breakdown:

Strengths:

- Real-time notifications for all transactions

- Intuitive fund management between crypto wallets and card balance

- Instant freeze/unfreeze capability for security

- Detailed transaction history with merchant information

- Customizable spending limits adjustable on-the-fly

Weaknesses:

- Limited customization options for notification preferences

- Forver dark mode (No theme selection)

The app currently holds a 3.8/5 rating on the App Store and 4.1/5 on Google Play—decent but not outstanding scores that align with my experience.

The security features deserve special mention—the app includes optional 2FA for all sensitive actions, biometric authentication options, and session timeout controls that exceed industry standards.

Customer Support: A Mixed Bag of Responses

Customer support can make or break a financial product. Redotpay offers three primary support channels:

- In-app chat support: Not available

- Email support Advertised 24-hour response time. Works well

- Knowledge base with FAQs and guides it is still fairly limited

Physical cardholders do receive priority support as promised, with noticeably faster response times. However, the quality of resolution doesn't significantly differ between card tiers.

Redotpay vs. Major Competitors

To truly understand Redotpay's position in the market, we need direct comparisons with major competitors:

Redotpay vs. Crypto.com Card

- Cost: Redotpay wins with no-stake 1% vs. Crypto.com's staking requirements

- Supported Cryptocurrencies: Crypto.com wins with 20+ vs. Redotpay's 5

- International Fees: Crypto.com wins with lower forex fees

- Perks: Crypto.com wins with more extensive benefits (Spotify, Netflix rebates, etc.)

- Accessibility: Redotpay. Available in most countries unless senctioned.

Redotpay vs. Binance Card

- Cost: Tie at 1%, but Binance requires higher trading volume

- Supported Cryptocurrencies: Binance wins overwhelmingly

- Fee Structure: Binance wins with lower overall fees

- User Experience: Redotpay wins with simpler, more intuitive processes.

- Availability: Binance wins with wider global availability

Redotpay vs. Wirex Card

- Fee: Tie. Both have fair and clear fee disclosure

- International Usage: Wirex wins with lower forex fees and better terminal acceptance

- Card Options: Wirex wins with more flexible card tiers

- App Experience: Wirex wins with a more modern, feature-rich application

These comparisons reveal Redotpay's true position: It excels in straightforward payment without complex requirements but falls short in currency support and international usability.

Security Analysis: Solid Fundamentals

Security should be non-negotiable for any financial product. Redotpay implements several industry-standard security measures:

- Multi-factor authentication for all account actions

- Cold storage

- Partnership with Fireblocks

What's notably missing is a comprehensive bug bounty program - something that competitors like Crypto.com and Binance have implemented with great success.

This raises questions about how thoroughly their systems have been battle-tested against potential vulnerabilities.

Redotpay has never experienced a major security breach, which is commendable.

However, the platform's relatively smaller user base makes it a less attractive target for hackers compared to giants like Binance or Crypto.com.

The most significant security advantage Redotpay offers is its simplified ecosystem.

With fewer moving parts than multi-service platforms, there are inherently fewer attack vectors—a case where simplicity enhances security.

Pros and Cons: The Unvarnished Truth

After months of testing, here's my balanced assessment of Redotpay's strengths and weaknesses:

Pros:

- No-stake 1% fee beats most competitors' base offerings

- No monthly fees keeps long-term costs predictable

- Simple two-tier card system avoids unnecessary complexity

- Strong transaction acceptance rate (80% in supported regions. Better than most)

- Rapid transaction notifications provide real-time spending awareness

- Quick to start

Cons:

- 1% foreign transaction fee penalizes international users

- Limited cryptocurrency support (only 5 currencies)

- Geographic restrictions (no Russia)

- Inconsistent customer support quality for complex issues

Who Should Get the Redotpay Card?

After thorough testing and analysis, the ideal Redotpay user profile becomes clear:

I recommend it for crypto holders who primarily use BTC, ETH, or stablecoins and want simple spending access. This will be a life saver for moderate spenders who can benefit from simplicity and need high limits

However, it is not recommended if your country is not in the allowlist. Or you are a user with diverse crypto portfolio who want to spend multiple altcoins. It is also not for Users seeking premium perks.

Final Verdict

The value proposition is clear—Redotpay excels at simplicity and no-strings-attached rewards.

In a market where competitors continuously add complex requirements and tiered systems, this straightforward approach is refreshing.

Looking forward, Redotpay has announced plans to expand cryptocurrency support and potentially enter new markets.

They have the potential to become a market leader rather than just a solid contender.

Frequently Asked Questions

How long does card activation take after approval?

Virtual cards are activated instantly upon approval. Physical Premium cards typically arrive within 7-14 business days and require activation through the app.

Can I use Redotpay without completing full KYC verification?

Unlike some competitors that offer limited functionality before full verification, Redotpay requires complete KYC before any card usage.

What happens if I lose my physical Redotpay card?

You can instantly freeze the card through the app. You can order a brand new card Replacement card that can typically arrive within 10-14 business days.

Does Redotpay work with Apple Pay or Google Pay?

Currently, only Google Pay and Apple Pay integration is available, and only in select European countries.

What happens if my card is declined?

The app provides immediate notification of declined transactions with a reason code. Common reasons include insufficient funds, merchant restrictions, or suspicious activity detection.

Can I use Redotpay at merchants that typically block crypto cards?

Yes, in most cases. Redotpay operates through traditional payment rails that don't identify the card as crypto-linked to the merchant's payment processor.

The Bottom Line: Is Redotpay Worth It in 2025?

Redotpay offers a compelling package for specific users. If you primarily spend domestically, value straightforward rewards without staking requirements, and hold mainstream cryptocurrencies, it's a strong contender that deserves a place in your wallet.

For international users or those seeking premium perks beyond cashback, better options exist in the market. The high forex fees and limited cryptocurrency support are legitimate drawbacks that shouldn't be overlooked.

What makes Redotpay stand out is its rejection of the industry trend toward ever-increasing complexity.

In a market where competitors constantly move the goalposts with changing reward structures and requirements, Redotpay's transparent, no-strings-attached approach feels like a breath of fresh air.

As the crypto card market continues to evolve, Redotpay's position as the "straightforward option" gives it a unique edge that more complicated competitors might find hard to match.

What's your experience with Redotpay or other crypto cards? Share in the comments below!

This review is regularly updated based on personal testing. Your experience may vary based on location, spending patterns, and future platform changes.